By Alan Turner, Forth Capital

The Government has, once again, avoided calls from the All-Party Parliamentary Group on Frozen British Pensions to rule out freezing pensions for EU-resident British expats after Brexit.

When challenged to clarity their position in the Lords, Baroness Mobarik, a Government spokesperson in the Lords, said that she was not able to give the noble Baroness any more guarantee than she has already.

All she had previously said in the debate was that freezing state pensions overseas is a long-standing policy of successive Governments which has been the case for almost 70 years and there are no plans to change the policy.

The policy that she references causes pensioners in Australia, Canada and many other locations to see their state pension value frozen from the time they left the UK and they do not benefit from any increases made since.

Speaking in a House of Lords debate on Thursday 16 March 2017, Baroness Benjamin had raised concerns within the British expat pensioner community in the EU, that the government has not provided more reassurance to them that they won’t end up with a frozen pension.

In recent years, the Government has stuck firmly to its position to uprate only where they have a legal requirement to do so. But for those living in the EEA, this legal requirement is currently derived from membership of the single market, which the UK is now set to leave.

Baroness Benjamin said: “My understanding, therefore, is that the Government will now either need to determine a legally binding social security deal as part of the exit package or be forced to act unilaterally to maintain uprating rights for EU-resident British pensioners.”

“That the Government should take this opportunity—when so much else is up in the air—to take a more fundamental look at their approach to payment of the state pension overseas. A modern, global Britain should surely recognise that the movement of its people is a good thing. A modern state pension system should recognise, support and encourage this, especially at a time when our ageing population is putting increasing strains on public services here at home.”

Towards the end of the debate Baroness Benjamin challenged the government to confirm whether it would apply its frozen pension approach to EU-resident British pensioners, stating that if it is going to be changed for one group, it is not fair to the other – citing the fact that expats living in the vast majority of locations see their pensions frozen in accordance with the historic policy referenced earlier.

Baroness Mobarik simply responded by saying only that this was out with the scope of the debate.

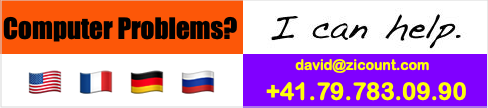

Do you have enough saved for your retirement?

At Forth Capital we are renowned experts in the field of expat retirement planning. If you are concerned about your own retirement provisions, or would simply would like to have an independent review of your current retirement planning situation and your retirement planning goals, then you should contact us today to speak with one of our specialists.

Author's bio

Alan entered the international financial services sector when he relocated to Frankfurt in 2005 to take up an advisory support role. After 18 months in that role, Alan joined Forth Capital in Geneva during its launch phase to provide the existing advisory team with marketing and business development support. Alan was integral to the growth of the company in Geneva and later in the identification of potential new global markets.

After a short spell away from Forth Capital, spent launching a start-up marketing consultancy in the UK, Alan took on the global role of Business Development Director at the start of 2014. He now heads up the global sales and marketing function across all of Forth Capital’s branches, growing a team to support the company’s increasingly rapid growth.

Alan’s team facilitate the link between our advisers and our clients, handling enquiries and making every effort to ensure that those seeking advice are connected with the most appropriate member of our team to advise them on their specific financial planning requirements.

Now based in the Dubai office, Alan strives to bring Forth Capital’s high quality financial services offering to expatriates across the world through effective professional marketing channels and promotional work.