By Mark Routen, Forth Capital

On the 16th March the Chancellor will deliver the 2016 budget. This will be against a backdrop of uncertainty caused by the EU referendum to be held on the 23rd June and also in a difficult worldwide financial market place, where performance has not been as expected and growth is not reaching the expected levels.

There is still the deficit to be repaid and while the UK economy is doing well the financial markets are suffering and the pound is down.

Against this backdrop the Chancellor has to create a 2016 budget that will help repay the deficit without damaging the shoots of recovery and without alienating a section of the electorate that the remain campaign are relying on to keep the UK in Europe, a campaign of which he and the prime minister are key members of.

What can we expect from the 2016 Budget?

As always the popular choice will be to hit the perceived rich, although only this week a report has shown that by cutting the top rate of tax from 50% to 45% raised an additional £8 Billion in tax revenue. Even though this is a proven way to go, do not expect the top rate to drop to 40% anytime soon. There is likely to be some sort of tax giveaway to grab the headlines but this is more likely to be by extending personal allowances and increasing the level at which higher rate tax kicks in. There has also been a constant discussion in press about further attacks on pensions.

Pensions have been a prime target for a while, they are good politically as they can give an economic benefit to the government now, with the impact not felt by voters for years to come. The route taken to date has been to reduce the amount an individual can invest into a pension both on an annual and a lifetime basis, but now the focus has moved to restricting the tax relief given on the investment and a proposed attack on the tax free lump sum.

The attack on the tax free lump sum is not expected to happen this year, but its place in the discussion has two purposes, firstly to get the subject on the agenda for implementation in the future and secondly to make any changes actually made this year seem less onerous. We believe the tax free lump sum will be attacked in due course, but perhaps not this year.

What could happen this year is a restriction on the amount of tax relief given on contributions, at present they are paid net of basic rate tax and a taxpayer claims the higher rate tax relief on their self assessment return. There are proposals to either do away with the higher rate tax relief, or to offer a fixed rate of tax relief at say 25%, either of which will increase the cost of contributions to higher rate tax payers.

Pension Minefield

Pensions as a whole are a minefield for the government with the ageing population, and the increase in the state pension age reflects this, there are currently discussions about making this a sliding scale depending on the type of job you do, and how long you are likely to live for, based on your occupation or location. Private pensions are seen as vital for the future, although they are currently under attack for the very reason stated above, the long term aim of this government is to change from a system where you get tax relief on contributions to one where you pay out of taxed income, but receive the benefits tax free. How this will happen is unknown at this stage, but it is almost certainly going to cost some tax payers dearly at some point, most likely in the near future.

If you are an expat and have personal or company pensions, it could well be worth looking at moving this in to a QROPS in the near future, to protect against this uncertainty.

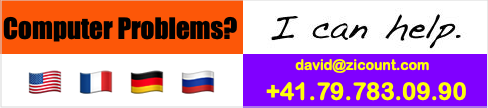

If you would like to speak to one of our pensions or tax planning team to discuss your own situation then please contact us visit our website, www.forthcapital.com.

Author's bio

With nearly 30 years experience in the taxation industry Mark joined Forth Capital in 2015 to assist with the development of the company’s tax offering. He has worked in the big four accountancy firms and has also run his own UK taxation consultancy. In addition he has worked in both Hong Kong and India.

Working overseas has given Mark a complete understanding of the tax and other financial issues facing expats and those either crossing tax borders or undertaking cross border transaction.

Mark is an associate of the Chartered Institute of Taxation.